Against the original target of opening bank accounts for 7.5 crore uncovered households in the country by 26th January, 2015, banks have already opened 12.54 crore accounts as on 31st January 2015 after conducting survey of 21.06 crore households with deposits exceeding Rs 10,000 crores. The target was set after conducting a survey of 21.02 crore households in the country. Today, a coverage of almost 100% has been achieved. Out of the accounts opened, 60% are in rural areas and 40% are in urban areas. Share of female account holders is about 51%.

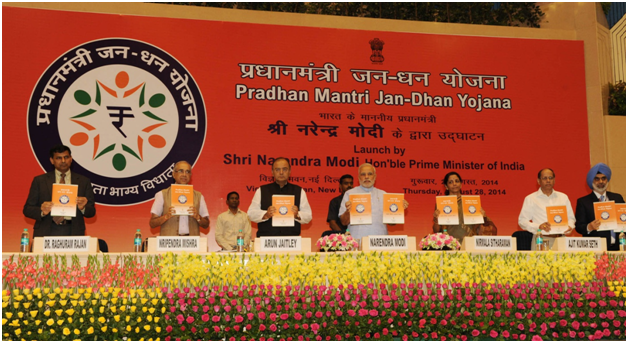

Pradhan Mantri Jan Dhan Yojana provides a platform for universal access to banking facilities with at least one basic banking account for every household, financial literacy, and access to credit, insurance, and pension facility. It covers both urban and rural areas and those who open an account would get an indigenous Debit Card (RuPay card). The account can be opened in any bank branch or Business Correspondent (Bank Mitr) outlet at zero balance. Every bank account is on the Core Banking System (CBS) of banks. Mobile banking using the USSD facility available on even basic feature phones is also being supported. A facility of call center and toll-free number are available nationwide.

PMJDY brings about the objective of financial inclusion for all by providing basic banking accounts with a debit card with inbuilt accident insurance. The main features of PMJDY include Rs. 5,000 overdraft facility for Aadhar-linked accounts and a RuPay debit card with inbuilt Rs. 1 lakh accident insurance cover. In addition, for accounts opened between 15th August 2014 and 26th January 2015, a Life Insurance cover of Rupees 30,000 is available to the eligible beneficiaries. One of the salient features of Pradhan Mantri Jan Dhan Yojana is that after remaining active for 6 months, the account holder will become eligible for an overdraft of up to Rs 5,000.

Under the scheme, financial literacy program which aims to take financial literacy up to the village level is provided for a better understanding of the whole mechanism. The Mission also envisages the extension of Direct Benefit Transfer (DBT) under various Government Schemes through the bank accounts of the recipients. The Kisan Credit Cards (KCC) are also being linked with the RuPay platform. Microinsurance to the people and unorganized sector Pension schemes like Swavalamban through the Business Correspondents have also been included in the second phase of the program.

The Pradhan Mantri Jan Dhan Yojana has a structured monitoring mechanism from the Central to District level. At the Centre, Finance Minister is the Mission head along with a Steering Committee and a Mission Director. The program is monitored at the State level by a State Implementation Committee and in the districts by a District Implementation Committee.

Thus, Pradhan Mantri Jan Dhan Yojana not only serves as an important example of Governance in Mission Mode but also demonstrates what a Government can achieve if it is committed to the welfare of the people.

0 Comments